how do you calculate inflation rate using gdp deflator

Understanding How to Calculate Inflation Rate Using the GDP Deflator

Calculating the inflation rate is essential for understanding the economic landscape of a country. As a professional with experience in economic analysis, I often find myself explaining complex concepts like inflation to various audiences. This article aims to elucidate how one can calculate the inflation rate using the GDP deflator, a crucial but sometimes overlooked economic indicator.

What is the GDP Deflator?

Before diving into calculations, it's essential to define the GDP deflator. The GDP deflator is a measure of the level of prices of all new, domestically produced, final goods and services in an economy. It is a broader measure than the Consumer Price Index (CPI), capturing price changes across the entire economy and not just a basket of consumer goods.

In simple terms, the GDP deflator can be understood using the following formula:

[

\textGDP Deflator = \frac\textNominal GDP\textReal GDP \times 100 ]

Where:

- Nominal GDP represents the value of all finished goods and services produced within a country's borders in a specific time period, measured at current market prices.

- Real GDP is the value of all finished goods and services produced within a country, adjusted for inflation or deflation.

Steps to Calculate the Inflation Rate Using the GDP Deflator

Calculating the inflation rate using the GDP deflator involves a few essential steps:

Gather Data: Collect data for nominal GDP and real GDP for the years you are analyzing.

Calculate the GDP Deflator:[ \textGDP Deflator for Year X = \frac\textNominal GDP for Year X\textReal GDP for Year X \times 100

]

Calculate the Inflation Rate:[ \textInflation Rate = \frac\textGDP Deflator for Year X - \textGDP Deflator for Year (X-1)\textGDP Deflator for Year (X-1) \times 100 ]

This formula captures the percentage change in the GDP deflator from one year to the next, effectively reflecting the inflation rate.

Example Calculation

To provide a clearer understanding, let’s consider an example:

| Year | Nominal GDP (in billions) | Real GDP (in billions) | GDP Deflator |

|---|---|---|---|

| 2022 | 2,000 | 1,800 | 111.11 |

| 2023 | 2,200 | 2,000 | 110.00 |

Step 1: Calculate the GDP deflator for 2022 and 2023.

- For 2022: [ \textGDP Deflator = \frac20001800 \times 100 \approx 111.11 ]

- For 2023: [ \textGDP Deflator = \frac22002000 \times 100 = 110.00 ]

Step 2: Calculate the inflation rate from 2022 to 2023. [ \textInflation Rate = \frac110.00 - 111.11111.11 \times 100 \approx -1.00% ]

This outcome reflects a deflationary trend, indicating that, on average, prices across the economy have decreased by approximately 1% when comparing these two years.

Importance of the GDP Deflator

As I navigate through economic reports and analyses, I cannot emphasize enough the importance of understanding the GDP deflator. Here are several reasons why it is crucial:

- Comprehensive Overview: The GDP deflator accounts for both consumer goods and capital goods, providing a more broad-based understanding of price changes in the economy.

- Real Economic Growth: It helps in differentiating real economic growth from nominal growth, assisting policymakers and economists in making informed decisions.

- Policy Formulation: The deflator is crucial for central banks when designing monetary policies, as it influences interest rate decisions and inflation targets.

Related Quotations

"Inflation is taxation without legislation." - Milton Friedman

This quote from the renowned economist Milton Friedman resonates strongly when discussing inflation, underscoring the difficulty of managing it effectively and its overarching effects on the economy.

Frequently Asked Questions (FAQs)

1. What is the difference between the GDP deflator and the Consumer Price Index (CPI)?

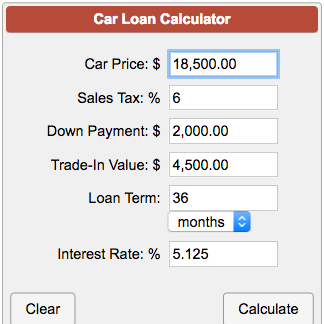

The GDP deflator measures the price changes of all domestically produced final goods and services, while CPI reflects the price changes for a basket of consumer goods and services. In loan calculator to CPI, the GDP deflator is not based on a fixed basket of goods.

2. Why is the GDP deflator so significant for economic policy?

The GDP deflator is crucial for assessing inflation, adjusting economic data for real growth, and for making informed decisions regarding fiscal and monetary policy.

3. Can the GDP deflator be negative?

Yes, if nominal GDP decreases while real GDP remains constant (or increases), the GDP deflator can yield a negative value, which suggests a deflationary situation.

4. How often is the GDP deflator updated?

The GDP deflator is typically updated quarterly as part of national accounts releases, as new data for nominal and real GDP becomes available.

Conclusion

Calculating the inflation rate using the GDP deflator is an essential skill for anyone involved in economic analysis, policy-making, or finance. By understanding its fundamentals, we can better assess the economic conditions and trends that shape our lives. I encourage those interested in economics, whether students, professionals, or curious minds, to explore the applications of the GDP deflator and its implications in real-world scenarios.

In essence, the GDP deflator serves as a vital tool in our understanding of inflation rates and economic health, enabling informed decisions that can significantly affect financial landscapes and everyday lives.